The way we pay for goods and services is undergoing a remarkable revolution. Cash, once the king, is rapidly losing its crown to a new era of digital transactions powered by innovative fintech software development services.

In India, this transformation is particularly evident, with the rise of Unified Payments Interface (UPI) and popular mobile apps like PhonePe, Google Pay, and Paytm redefining the landscape for both consumers and businesses.

Table of Contents

ToggleThe Rise of Fintech Software Development Services

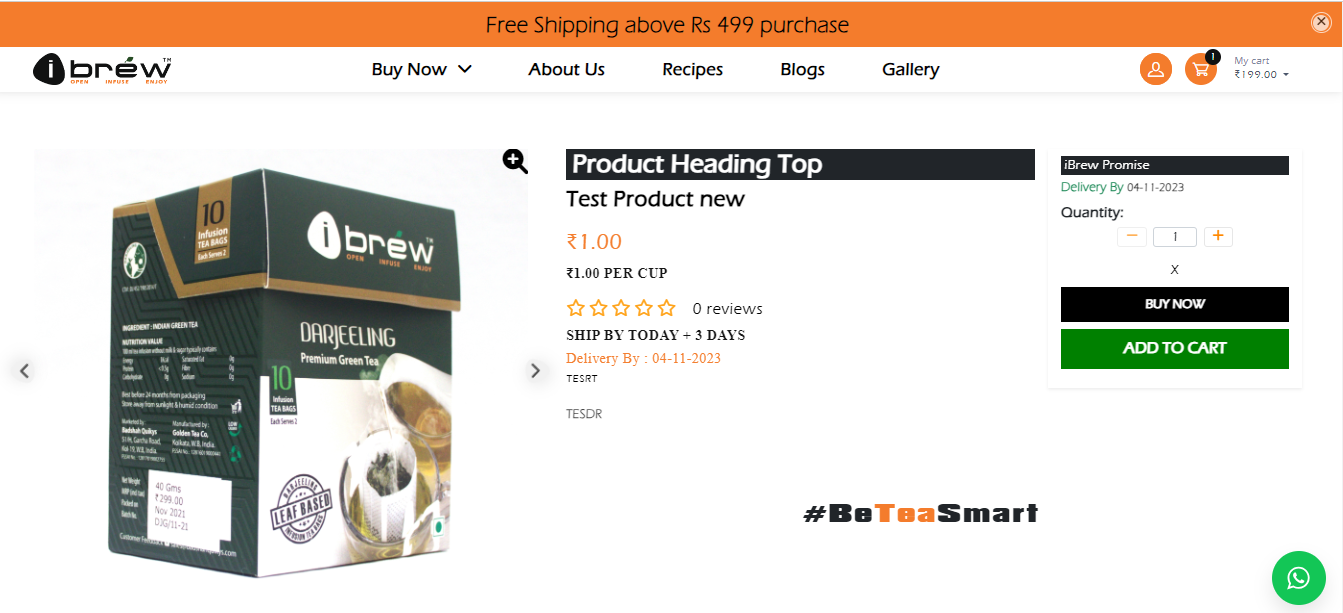

Fintech software development contains the creation of software applications specifically designed to simplify and enhance financial transactions. This includes a vast array of solutions, from mobile wallets and peer-to-peer (P2P) payment platforms to contactless payment systems and sophisticated fraud detection tools.

Fintech software development companies in India are playing a crucial role in this global shift. Their expertise allows businesses of all sizes to embrace the power of digital payments, offering a multitude of benefits:

- Enhanced User Experience: Fintech apps like PhonePe, Google Pay, and Paytm provide a user-friendly and intuitive interface for making and receiving payments. The days of struggling with bills or trying to memorize long account numbers are over; now all it takes is a few touches on your phone.

- Increased Speed and Efficiency: There are no pauses in transactions when fintech software is used. This allows businesses to close deals faster, improve customer satisfaction, and streamline their financial operations.

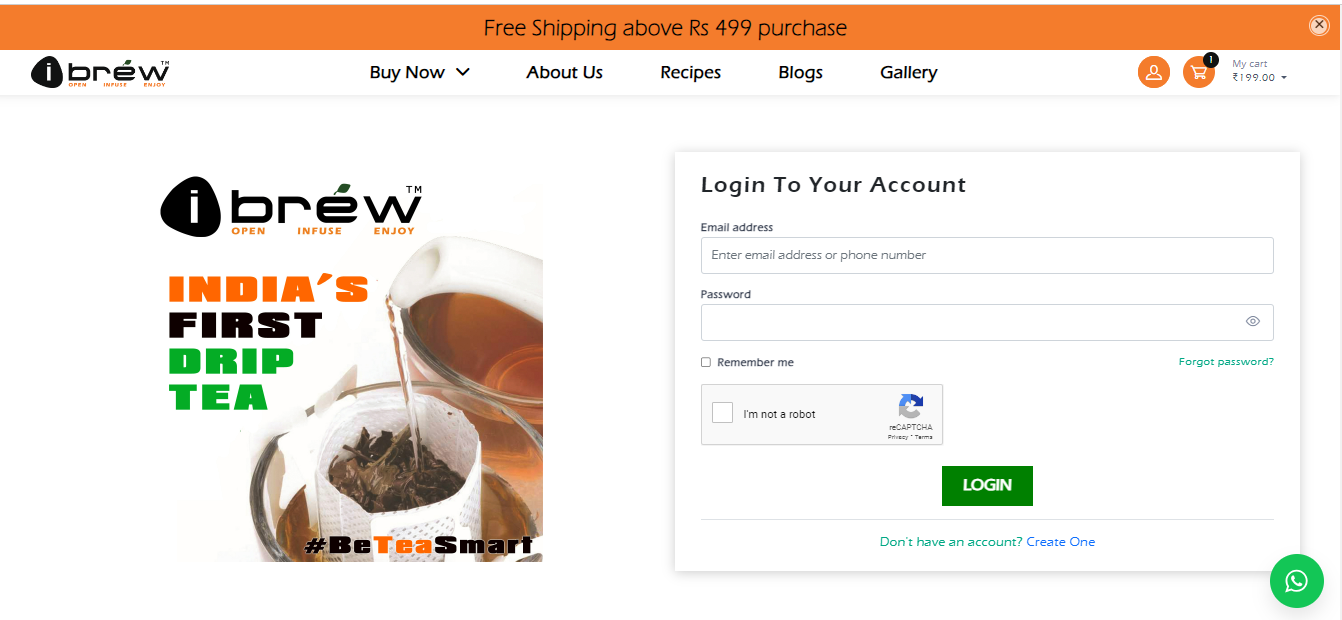

- Improved Security: Fintech software developers prioritize robust security measures to protect sensitive financial data. Encryption, multi-factor authentication, and advanced fraud detection systems safeguard transactions, providing peace of mind for both businesses and consumers.

- The Power of UPI: The emergence of the Unified Payments Interface (UPI) in India has been a game-changer. This open-source platform developed by the National Payments Corporation of India (NPCI) allows for real-time interbank transactions between any participating bank accounts. UPI integration within fintech software authorizes businesses to leverage this robust and secure payment infrastructure, reaching a wider customer base and facilitating seamless transactions.

The Future of Payments: What Lies Ahead

Fintech software development continues to grow, we can expect to see even more innovative solutions shaping the future of payments:

- Biometric Authentication: Fingerprint and facial recognition technologies offer a secure and convenient way to authenticate transactions, further enhancing user experience and security.

- Blockchain Integration: Blockchain technology offers unparalleled security and transparency for financial transactions, paving the way for secure and efficient cross-border payments.

- Open Banking: Open Banking APIs allow third-party providers to access customer financial data with consent, enabling the creation of personalized financial products and services.

- The Rise of Contactless Payments: Contactless payment solutions like NFC (Near Field Communication) are becoming increasingly popular, offering a fast and hygienic way to make payments at physical stores.

Conclusion

Fintech software development is driving a paradigm shift in the way we manage our finances. By fostering secure, convenient, and efficient payment solutions, it has the potential to revolutionize the financial landscape on a global scale. As fintech software development companies in India continue to break new ground, the future of payments promises to be even more exciting and transformative.

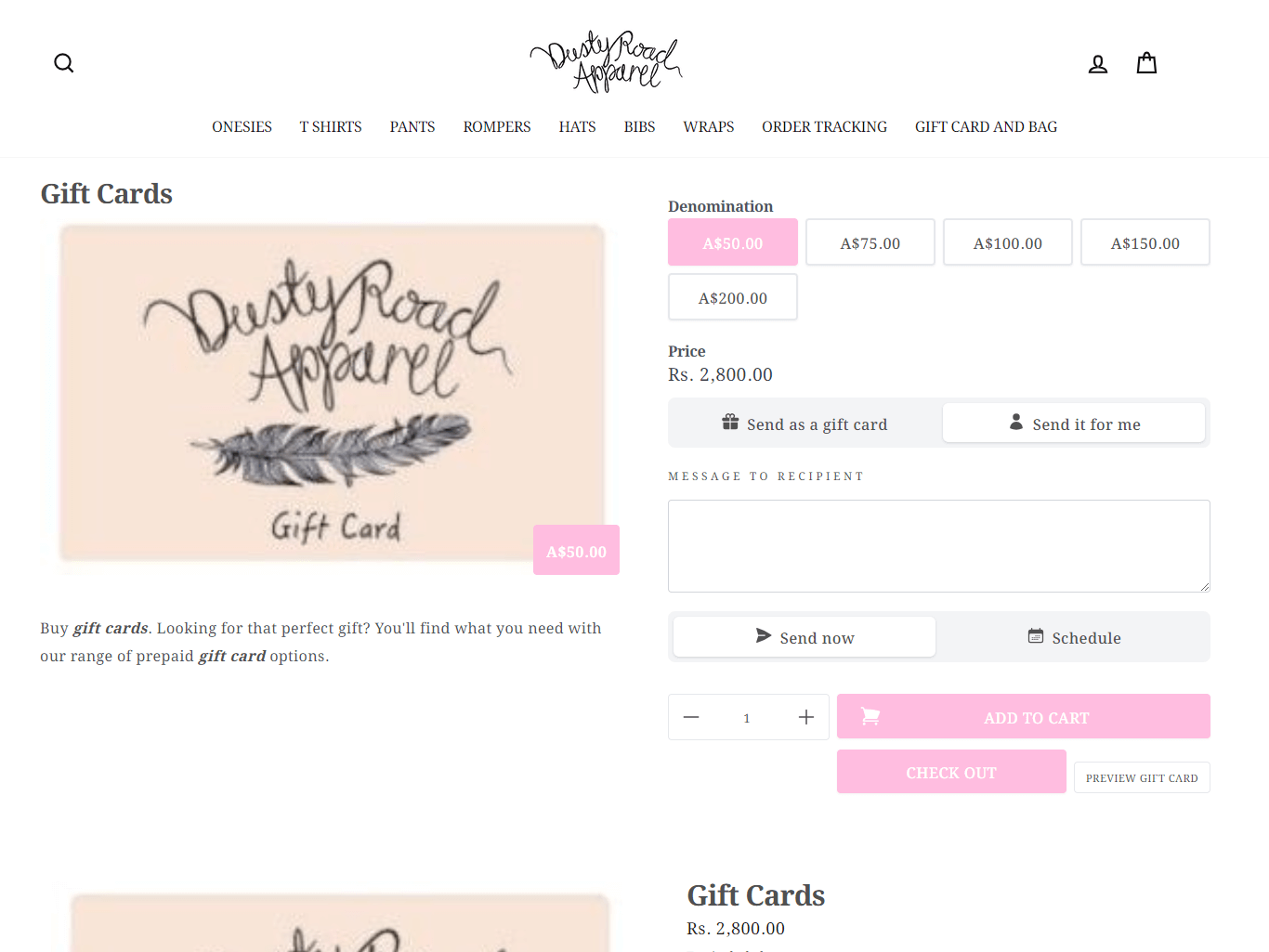

Looking for a Fintech Software Development Partner in India?

Web Idea Solution has the knowledge and experience to guide you through the complex and changing field of digital payments. We are a top fintech software development company in India. We provide a full range of development services to meet your unique fintech demands innovatively and securely. Reach out to us today to explore how we can ready your organization to succeed in the world of emerging payment methods.